Sustainable future – in hands of our Masters in Finance

With the end of the winter cold, the third module of the Master’s programme “Finance” has also finished. The first-year students are awaiting business projects in companies ahead, and senior students are preparing their final dissertations based on the results of practice-oriented research. Let us find out what educational event can be highlighted as the most interesting at the programme by its academic supervisor, Ph.D., associate professor of the Department of Finance Nazarova Varvara Vadimovna:

It is quite difficult to select the one thing most interesting for students as each year we enrich our programme with increasing number of the cut edge topics, projects and guest lecture from business. To organise educational events, especially in English, with prominent companies and highly busy top-managers is a complicated and time-consuming job, but we are constantly succeeding in it.

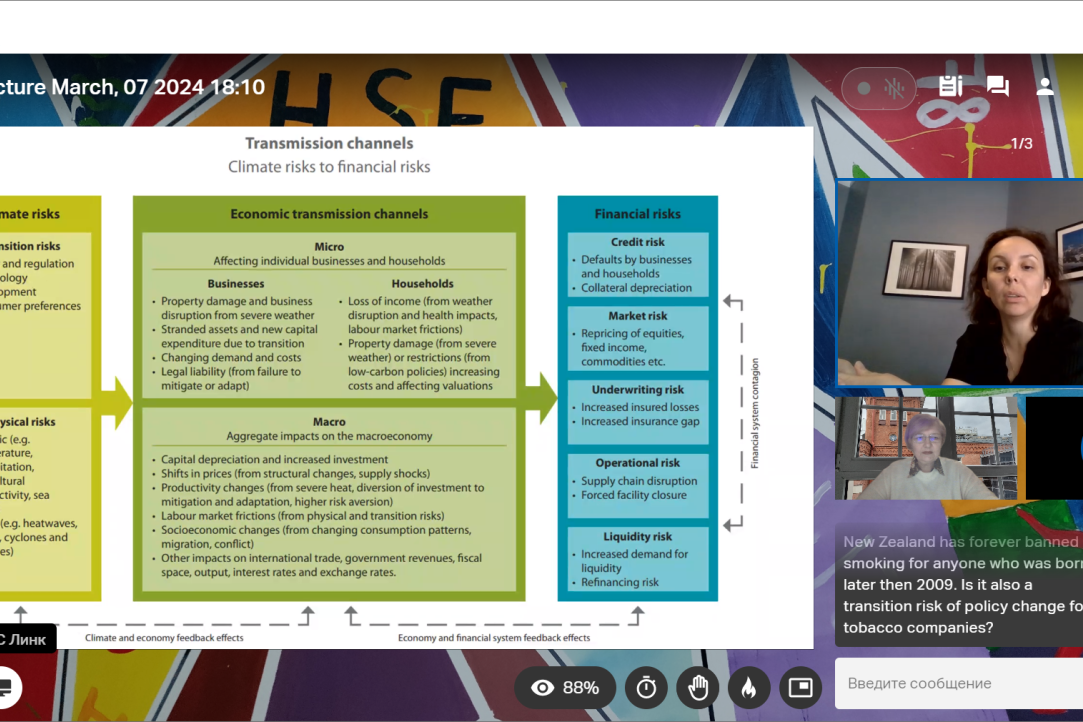

Well, I would probably need to highlight one lecture yet. It was delivered within the course “Sustainable Finance” which is held by the Ph.D., MBA, associate professor-practitioner Makarova Olga Vsevolodovna. We were lucky to engage a very rare high professional of top international level, sustainability director of Green Nexo Inc., MBA, member of academic council MP “Finance” Zugria Litvinova, who had run one of the classes.

The topic “Sustainability and Climate Risks to Financial Stability” is not a trivial one. Despite of common understanding of the high actuality of the climate change agenda, the reality is that projects in that direction require huge corporate direct investments and transactional costs. How should one persuade the corporate world to invest money into that sound to be non-profitable activity and to finance these or that ESG-related projects?

There are more questions than answers in here so far, the students initiated discussion and presented their views on the problem. The lecturer introduced future Masters in Finance into the structure of ESG risks analysis, types of risks and its influence on corporate financial performance results. At the end of the lesson, students worked over the case and analysed ESG risks for two international companies.

The cut-edge challenges, formulated in the global ESG agenda, not just take the minds of the youth but also speedily becoming the direct zone of responsibility of the new age managers. We have to admit with some sadness that generally modern education yet is not enriched enough with the ESG agenda. The delivered lecture as well as the whole course “Sustainable Finance” stay to be a unique value proposition for the master in finance programs in Russia.