Financial Reporting is not Enough

"Up to 80% of a business's value today can be in intangible areas. While financial reporting remains a very important pillar of corporate reporting, it is not enough on its own to explain how an organization creates value over time", – Neil Stevenson, Managing Director (Global Implementation) of International Integrated Reporting Council (IIRC), participant of the 12th Interdisciplinary Workshop "Intangibles, Intellectual Capital and Extra-Financial Information", is sure.

Today professional experience, knowledge and relationships are becoming increasingly important and, as results, human capital is becoming one of the most important resources in the business environment. Should we take it into account and, if so, in which way? Integrated reporting provides organizations an opportunity to bring together the financial and non-financial information and show the ability of companies to create and maintain their value in the short, medium and long term.

Before his speech at the 12th Interdisciplinary Workshop "Intangibles, Intellectual Capital and Extra-Financial Information" Neil Stevenson, Managing Director (Global Implementation) of International Integrated Reporting Council (IIRC) shared his vision of the problem with HSE website editorial office.

"Value creation by organizations around the world increasingly relies on people, intellectual capital and technology at the heart of their strategy and business model. Traditional corporate reporting has often focused on financial capital. Yet up to 80% of a business's value today can be in intangible areas. While financial reporting remains a very important pillar of corporate reporting, it is not enough on its own to explain how an organization creates value over time.

This finding is well illustrated by the work of the Corporate Reporting Dialogue, convened by the International Integrated Reporting Council, with participation from leading international frameworks and standards. In a review of the coverage of reporting frameworks across the corporate reporting landscape, it can clearly be seen that there is less coverage relating to intellectual and human capital. This is a link to the Corporate reporting landscape map.

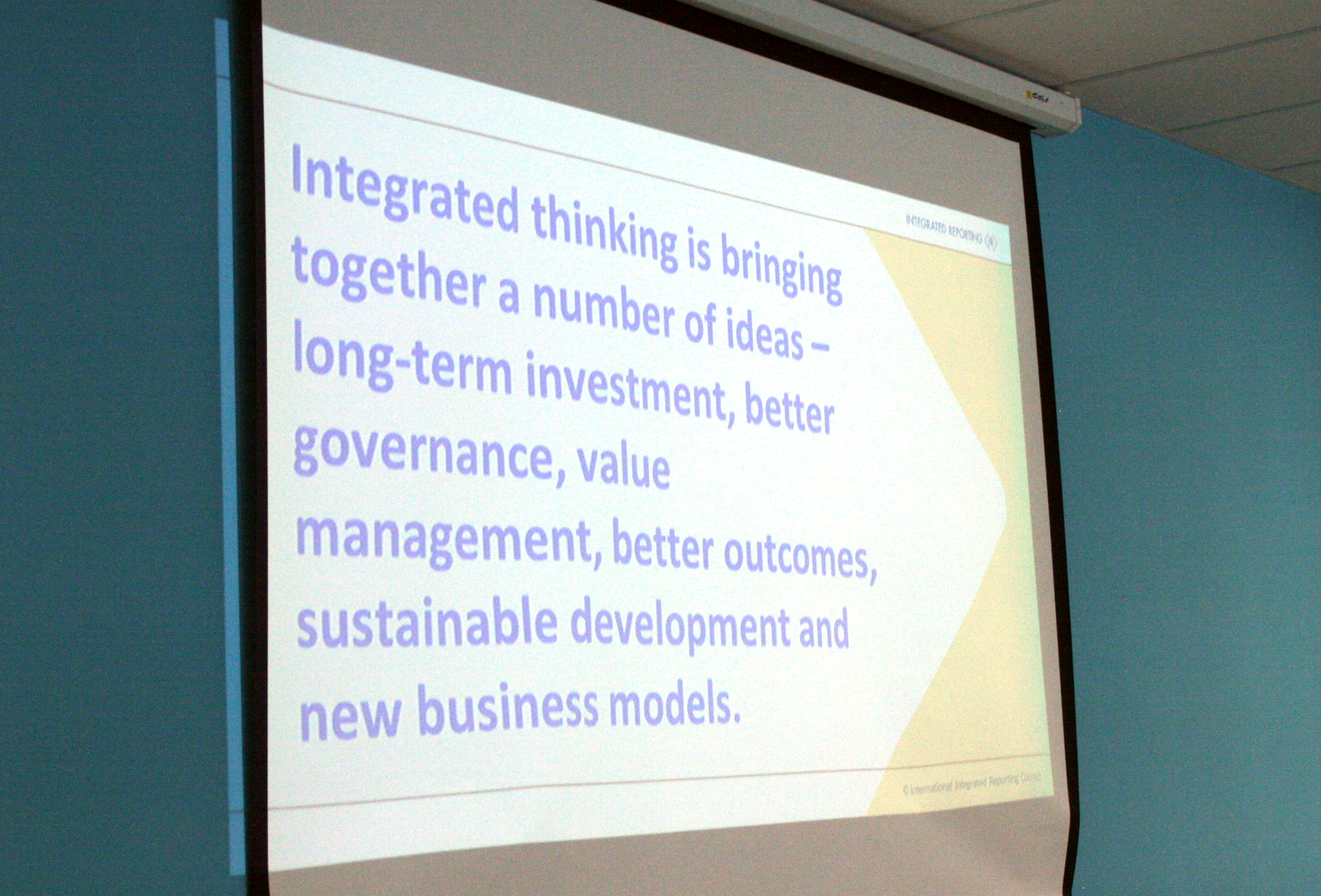

In the view of the IIRC, there are six broad areas of resources (capitals) that organizations draw on in various measure to create value: financial, manufactured, intellectual, human, social & relationship, and natural. We believe it is important for organizations to communicate to providers of financial capital, including investors, on all the resources they use and affect to create value. We also believe that through this process, organizations can enhance more holistic strategic thinking (which we call integrated thinking). Ultimately, we believe that a better understanding and disclosure as to how organizations create value will influence corporate behaviours and investment decisions, aligned to wider goals of financial stability and sustainable development.

There are now over 1,000 organizations around the world on the journey to Integrated Reporting. The early insight from those organizations is that <IR> leads to better long-term decision making, enhanced engagement with investors, and improved understanding of the strategy and business model. Research is important as it helps to crystallize benefits and provide the foundations for increasing the pace and scale of adoption of <IR>. In particular, we welcome the value and rigour of independent academic research and insight, which helps to underpin leading practices by organizations. We value research which identifies direct benefits to organizations and evidence that <IR> has a positive impact on a longer-term focus for capital markets. We also welcome research that makes a tangible link between reporting and cycles of business and investment that encourage financial stability and sustainable development. Finally, there is much work to do to establish and promote commonly accepted reporting metrics and indicators for human, intellectual and relationship capital.

Some recent developments in the field include the preparation of the WICI intangibles framework. We have also welcomed research from the likes of Nanyang University and the National University of Singapore who have identified benefits to capital markets from Integrated Reporting. This builds on work carried out by Harvard Business School. We also recently published two reports which were the result of a call for research led by IAAER, ACCA and the IIRC. The IIRC has set up an <IR> Academic Network to promote greater connection to academic thinking. In turn, we will make connections across the IIRC family to facilitate strong linkages between organizations adopting <IR>, and their providers of financial capital, academic thinking and wider engagement with capital markets, policy makers and regulators around the world".